Market Data Monitoring (MDM): only top quality data informs trading

Buy-side firms, sell-side firms, and market data providers must keep their fingers on the pulse of the financial markets.

ITRS acquires IP-Label. Read the press release.

Buy-side firms, sell-side firms, and market data providers must keep their fingers on the pulse of the financial markets.

Financial firms need the ability to continually monitor and analyze market feeds, define parameters for data quality, and take rapid, corrective measures when issues occur. ITRS Geneos MDM enables sell-side firms to execute trades at the best price, buy-side firms to make informed investment decisions, and market data providers to deliver high quality service.

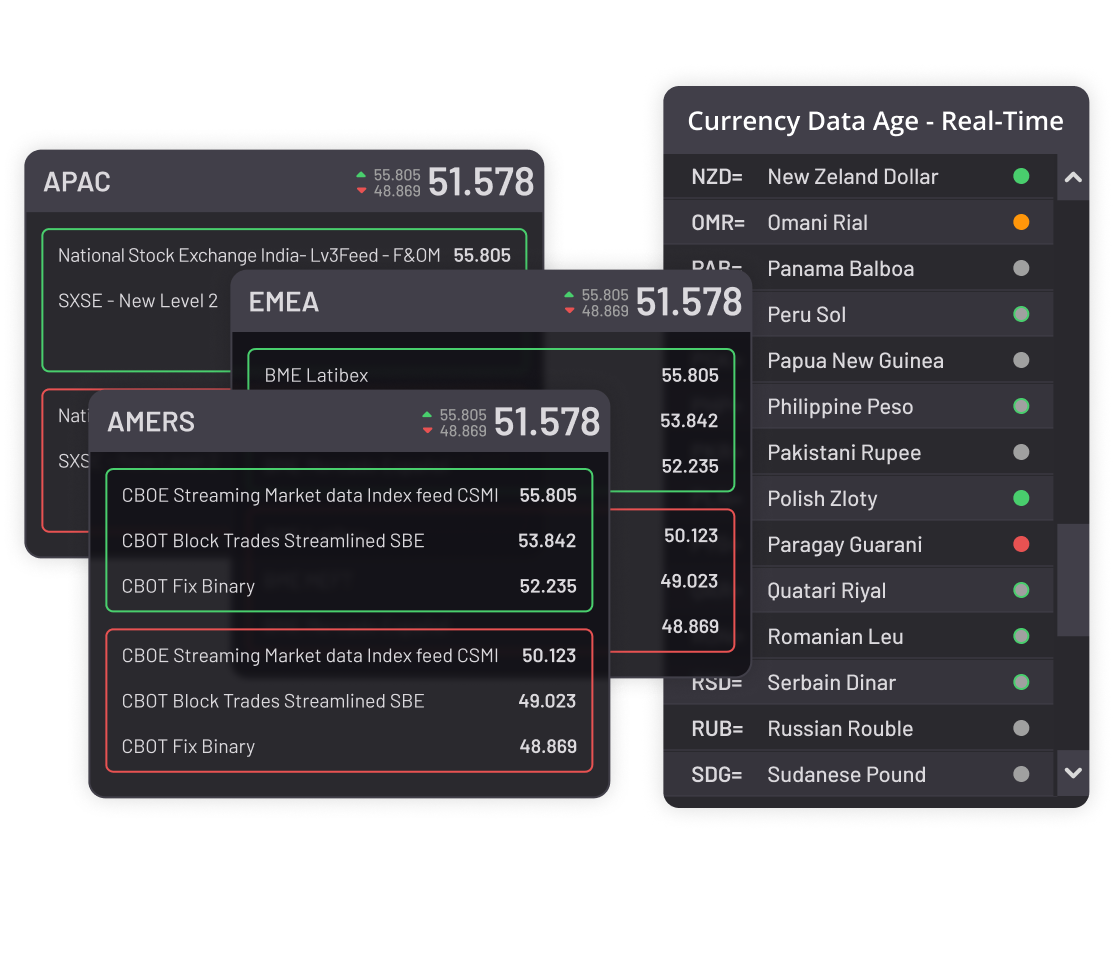

Each millisecond is an advantage. Financial firms need the ability to observe market feed latency and proactively address emerging issues before they affect trading.

Inaccurate data impacts revenue. By monitoring and comparing the update frequencies of market feeds, firms can guarantee they use only the most accurate data.

Financial firms need market data they can trust. Define custom benchmarks and alerts for latency and accuracy to make certain only the best data informs trading.

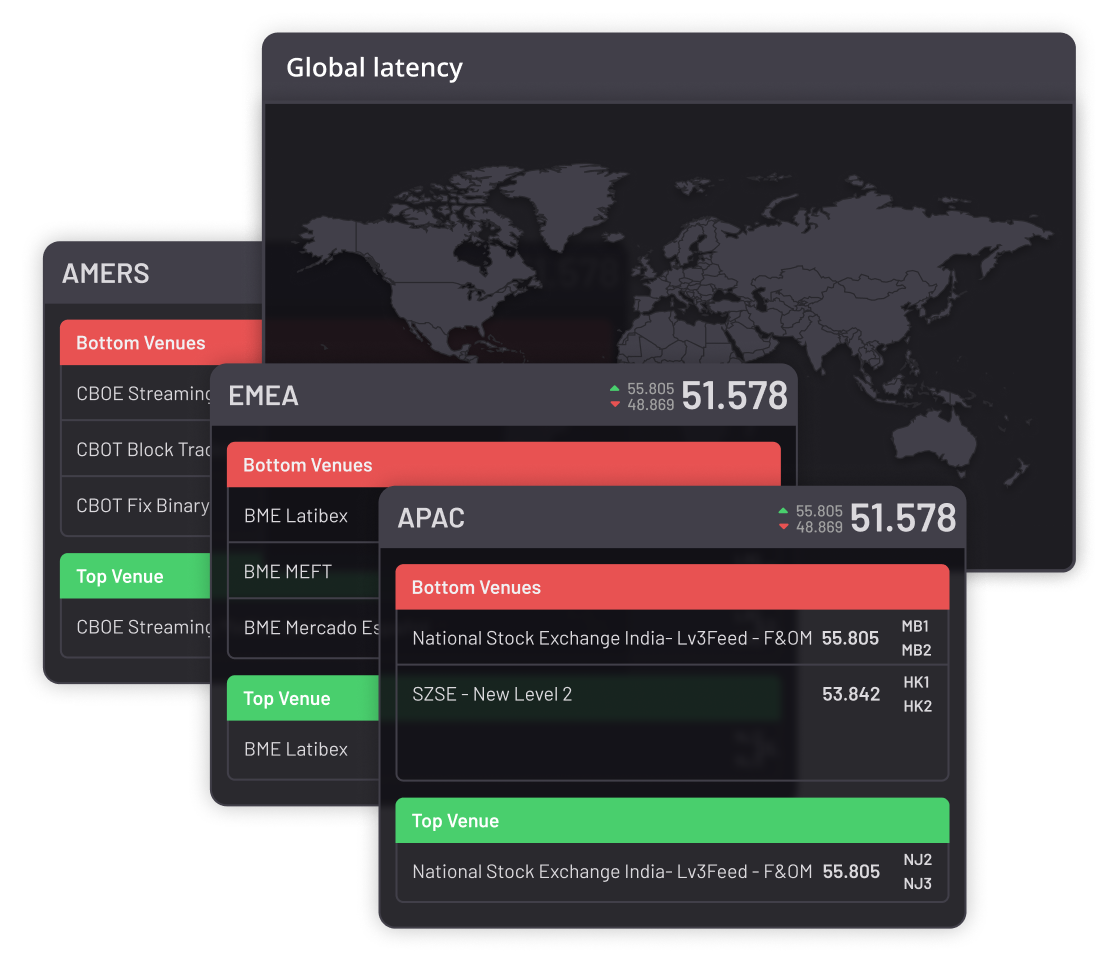

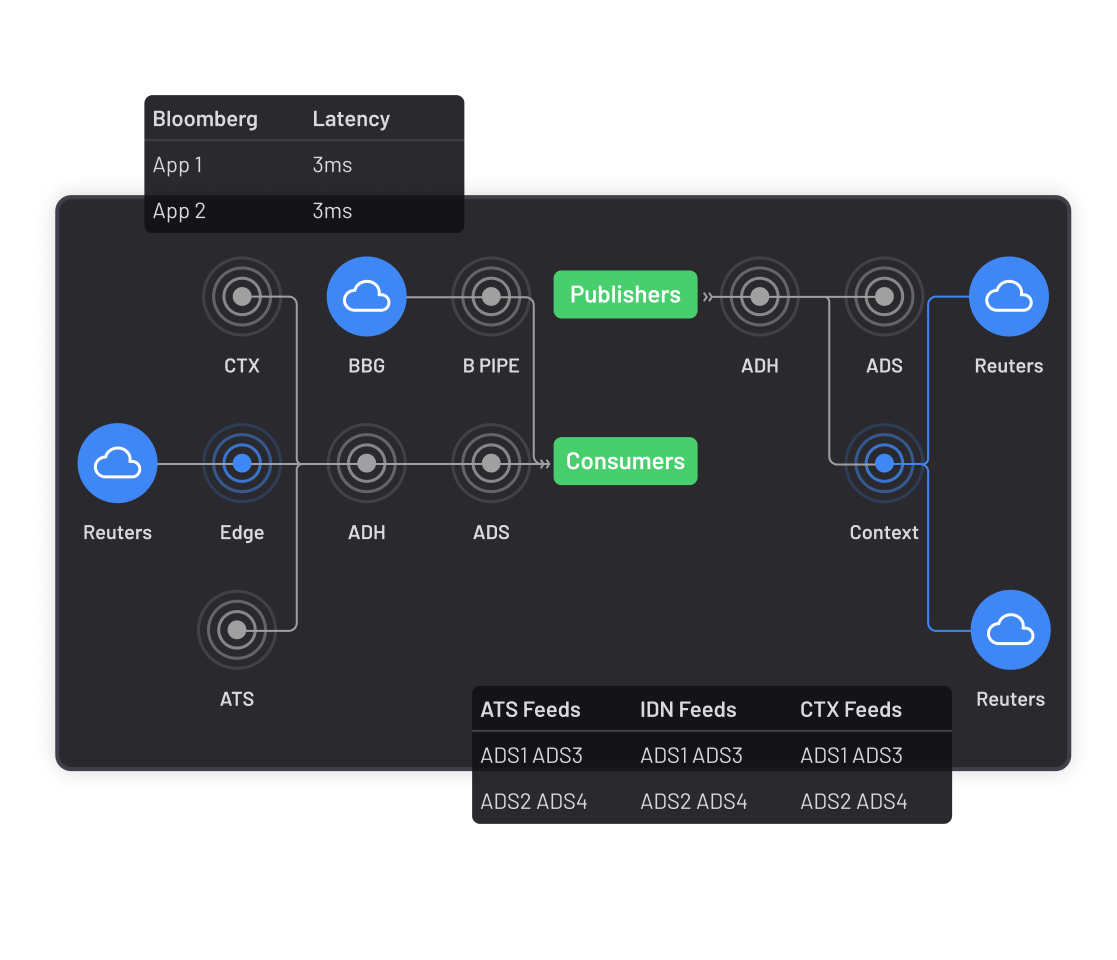

Geneos Market Data Monitoring lets you observe numerous market feeds and in-house data sources with ease. It holistically collects, analyzes, and visualizes feed performance metrics to fuel real-time views and alerting, while also identifying where issues occur to inform root cause analysis.

See how our MDM solution delivers real-time visibility over the quality of high-volume market feeds. For exchanges calculating and publishing prices, MDM seamlessly delivers critical insights that help maintain data accuracy and minimize latency.

Trust in a specialized solution for financial services. Rigorously monitor market feeds. Gain actionable insights to improve data quality.